5% Fuel Tax Not Newly Introduced, Implementation Of New Tax Laws May Not Begin Next Year-Wale Edun

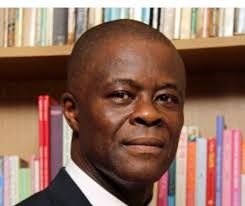

Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, has disclosed that the implementation of the new tax laws may not necessarily begin in 2026 while clarifying and asserting that the controversial 5% fuel tax had been in operation before now and not newly introduced.

Team@orientactualmags.com learned that Mr Wale Edun, who said this while talking to journalists in Abuja on Tuesday, added that the President Bola Tinubu administration has come up with most comprehensive tax reform in the history of the country.

‘Why does this 2007 speculation appear in the new Act? First, the Nigerian Tax Act Administration Act 2026, as it would be or 2025 when it was passed, did not create a new surcharge. It simply restated and harmonized the existing provisions into a single transparent framework of clarity and ease of compliance and I think it’s important to make (2:54) this distinction. The inclusion of the surcharge in the 2025 Nigerian Tax Administration Act does not mean an automatic introduction of a new tax.

It does not mean fresh taxation automatically. Now, the Nigerian Tax Administration Act, which was signed into law by Mr President in June, represents Nigeria’s most comprehensive tax reform in decades, as we know it’s a set of four bills overall. It is a major milestone in our efforts to modernize our tax administration and improve revenue mobilization while protecting citizens from excess burdens’ he said.

Submitting that the President Bola Tinubu administration will not take decisions that will make life difficult for Nigerians, he added that the federal government has only strengthened tax governance, and blocked revenue leakages.

‘I think I’ve clarified with regard to the fuel surcharge, it’s not long, it has existed, it’s nothing new, it has existed since 2007 and its inclusion in the new tax administration act 2025 is merely for harmonization, for transparency, there’s no immediate taking of the effects of the law and so forth and the government I must say is fully aware of the economic pressures of the time and will not take decisions that will make things even more burdensome, will not worsen the burden on Nigerians, our priority is to strengthen tax governance, block revenue leakages, improve efficiency rather than just levy new taxes, charges and costs’ he added.

The Finance minister also said the Bola Tinubu administration has remained committed to ensuring a strong, stable and growing economy that is driven by the private sector.

‘I think this shows that the reforms are deliberate, evidence-driven and based on consultation and research and so that really is the situation with the tax reform bills and as we know government’s economic vision remains to build an inclusive, strong and growing economy and to ensure that the private sector is given the opportunity, is given the enabling environment to invest, increase productivity, create jobs.

On a closing note, let me just say that our economic journey in 2025 is marked by renewed macroeconomic stability, there is growing investor confidence, there is an affirmation that we are in the right direction from development partners, international observers, international rating agencies amongst others and there is continued momentum for structural reform that is taking this economy from the current levels of growth to higher and more inclusive levels of growth’ he submitted-Team@orientactualmags.com

Do you have any information you wish to share with us? Do you want us to cover your event or programme? Kindly send SMS to 08035023079, 08059100286, 09094171980. Thank you