Tax Reform Bills ‘Product Of Brainstorm Sessions’-Presidency

The Presidency has reacted to the submissions made by Governor Babagana Zulum of Borno State, Senator Ali Ndume and others expressing worry about imminent quick passage of the controversial tax reform bills in the national Assembly unlike the Petroleum Industry Bill that took almost two decades to get passed into law.

Team@orientactualmags.com learned that the president’s Senior Special Assistant on Media and Publicity, Temitope Ajayi took to X.com on Monday to emphasize the importance of the bills noting that the reforms being proposed are the results of contributions from over 80 professionals over a period of 14 months.

‘It is very disingenuous to say that the Tax Reform Bills, the product of 14 months of extensive work by over 80 professionals drawn from every part of the country, are being rushed through the National Assembly.

The suggestion that it took the PIB over 20 years to get through the parliament is backward thinking. Nigeria lost too much for the failure to pass the PIB on time in terms of revenue, investments, and jobs in the oil & gas sector’ he said.

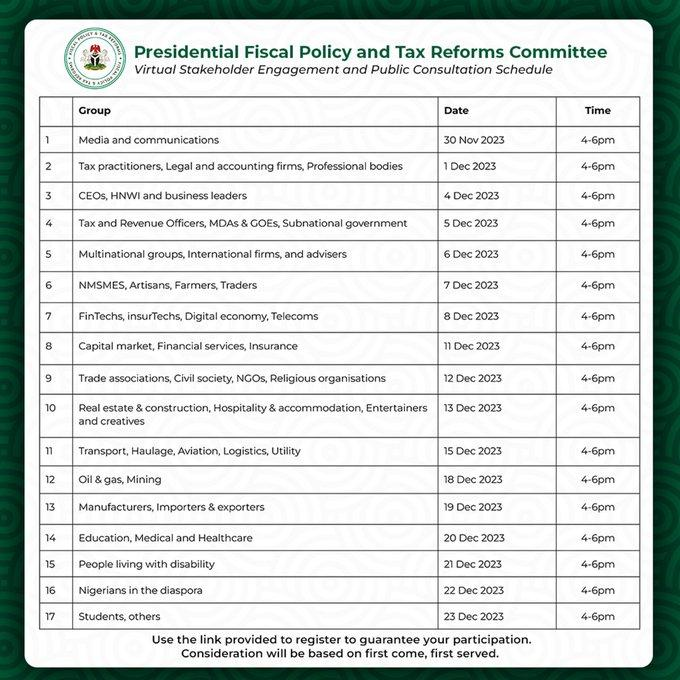

That was not all, Ajayi also made an image of itemized details of groups, dates, and time showing how experts brainstormed and eventually produced the ideas contained in the bills available.

Recall that the 19 Northern Governors had met on October 28, 2024, and declared opposition to the bills. They specifically rejected the new derivation-based model for Value-Added Tax distribution in the new bills.

The northern governors in a communiqué that was read out by their chairman, Governor Muhammed Yahaya of Gombe State, said what is contained in the proposed bills negates the interest of the North and other sub-nationals.

The Northern Elders Forum had also urged lawmakers from the north to oppose the Tax Reform Bills.

Recall also that the National Economic Council (NEC) had during its 144th meeting in Abuja asked the president to suspend action and withdraw the bills in question from the National Assembly in order to carry out a ‘wide consultation’ on them.

President Tinubu had however in a statement issued by his Special Adviser on Information and Strategy, Mr Bayo Onanuga submitted that the bills should be allowed to go through the legislative process since inputs can be made during public hearings.

He had also noted that doing what the NEC had recommended is unnecessary cognizant that the legislature has ‘amending power’.

Recall also that the four bills moved to the ‘committee stage’ in the senate on Thursday, November 28, 2024.

The resolution of the Senate followed the consideration of the general principles of the bills during the plenary session that was held last week.

The bills which were sponsored by Senate Majority Leader, Senator Opeyemi Bamidele are as follow;

‘A Bill for an Act to Establish the Joint Revenue Board, the Tax Appeal Tribunal and the Office of the Tax Ombudsman for the harmonization, coordination, and settlement of disputes arising from revenue administration in Nigeria and for related matters, 2024

A Bill for an Act to Repeal the Federal Inland Revenue Service (Establishment) Act, No.13, 2007 and enact the Nigeria Revenue Service (Establishment) Act to Establish the Nigeria Revenue Service, charged with powers of assessment, collection of, and accounting for revenue accruable to the Government of the Federation, and for related matters, 2024.

A Bill for an Act to Provide for the assessment, collection of, and accounting for revenue accruing to the Federation, Federal, States, and Local Governments; prescribe the powers and functions of tax authorities, and for related matters, 2024.

A Bill for an Act to Repeal certain Acts on taxation and consolidate the legal frameworks relating to taxation and enact the Nigeria Tax Act to provide for taxation of income, transactions, and instruments, and for related matters, 2024’.

After the second reading of the Bills, the Senate President, Barrister Godswill Akpabio ruled that they should be referred to the Committee on Finance for further legislative action.

The committee was given 6 weeks to submit its report-Team@orientactualmags.com Do you have any information you wish to share with us? Do you want us to cover your event or programme? Kindly send SMS to 08059100286, 09094171980 or get in touch via orientactualmag@gmail.com. Thank you