Taxation Without Production: Nigeria’s Road to Social And Economic Strangulation-Former Rep Zakari Mohammed

Every government must raise revenue. However, history has shown that governments that extract before they build, tax before they produce, and punish the citizens for failures they did not create often end in economic and political crisis. Sustainable governance requires that taxation should be the outcome of productivity, not a substitute for it.

Since taking office on May 29, 2023, President Bola Ahmed Tinubu has pursued an aggressively revenue-driven governance model. This approach has been defined by the abrupt removal of petrol subsidy, the expansion of taxes and levies, new surcharges, and extraordinary fiscal measures. What remains glaringly absent is a corresponding industrial and manufacturing revolution capable of absorbing the severe economic shocks imposed on Nigerians. The result is a growing perception of a state acting more as a tax master than a builder, presiding over a congregation of citizens increasingly reduced to economic servitude.

The announcement of the removal of petrol subsidy in his inauguration speech was the opening salvo. Almost overnight, fuel prices more than doubled, triggering higher transportation costs, increased food prices, and escalating production and logistics expenses across the economy. For millions of Nigerians, petrol subsidy removal functioned as a silent consumption tax imposed without buffers, proper sequencing, or viable industrial alternatives. It laid the foundation for inflationary pressure and shrinking real incomes, upon which further taxes would later be layered.

Since 2023, Nigerians have faced an expanding web of taxation. These include proposed and debated increases in Value Added Tax, new fuel surcharges and excise duties, expanded service and consumption taxes, tighter tax administration with harsher penalties, and a controversial retroactive windfall tax on banks’ foreign-exchange gains. These measures are defended as necessary to improve Nigeria’s low tax-to-GDP ratio, yet this argument ignores a fundamental truth: no economy can be sustainably taxed if it does not first produce.

The extraordinary windfall tax imposed on commercial banks revealed a deeper fiscal desperation. While framed as equity and the recovery of unearned profits, it sent troubling signals of policy unpredictability, retroactive taxation, and weak respect for capital formation. In the long term, such measures discourage lending, erode investor confidence, and weaken the financial system that should be funding industrial growth and job creation.

Nigeria’s manufacturing sector remains weak, fragile, and grossly under-supported, contributing only about 10 to 13 percent of GDP. This is far below what is required to generate mass employment or meaningful value creation. Factories continue to close or operate far below capacity due to unreliable power supply, high interest rates, insecurity, poor infrastructure, and costly imports driven by foreign exchange instability. Yet instead of prioritising industrial revival, government policy focuses on extracting revenue from consumption and services, the very sectors where ordinary Nigerians are already struggling. This contradiction sits at the heart of the Tinubu tax regime.

Nigeria has been here before. The Structural Adjustment Programme of the 1980s, imposed under Bretton Woods guidance, subjected the country to currency devaluation, subsidy removal, trade liberalization, and higher indirect taxes. The outcome was devastating. The textile industries of Kaduna, Kano, and Lagos collapsed, over half a million manufacturing jobs were lost, and Nigeria became deeply deindustrialized and import-dependent. Today’s policies echo that failed era, only with greater intensity and fewer safeguards.

There is increasing concern that Nigeria’s economic direction is being shaped more by World Bank and IMF orthodoxy than by domestic realities. The familiar script is unfolding again: subsidy removal, tax expansion, social pain, and deferred industrialization. Yet the World Bank does not contest Nigerian elections, the IMF does not experience ‘Nigerian hunger’, but the Nigerian president must answer to the Nigerian people. Rigid adherence to external fiscal templates without adaptation risks economic dislocation and political isolation.

Globally and locally, the lesson is consistent. Greece collapsed under tax-heavy austerity without growth. Sri Lanka imploded following IMF-style fiscal tightening. Argentina’s repeated tax hikes ended in social revolt. In Nigeria, governments that ignored public hardship, particularly around fuel pricing and taxation, faced protests, reversals, and loss of legitimacy. No country has ever taxed its citizens into prosperity.

The real burden of this tax regime does not fall on abstract economic entities. It falls on market traders, transport workers, civil servants, artisans, students, and families. These Nigerians are not refusing to pay taxes; they are being taxed without being empowered to earn. That is not reform. It is economic coercion.

Nigeria is not anti-tax. Nigerians are anti-injustice. Citizens willingly contribute revenue when government delivers functional factories, affordable power, secure roads, jobs, and opportunity. Taxation without development is oppression by policy.

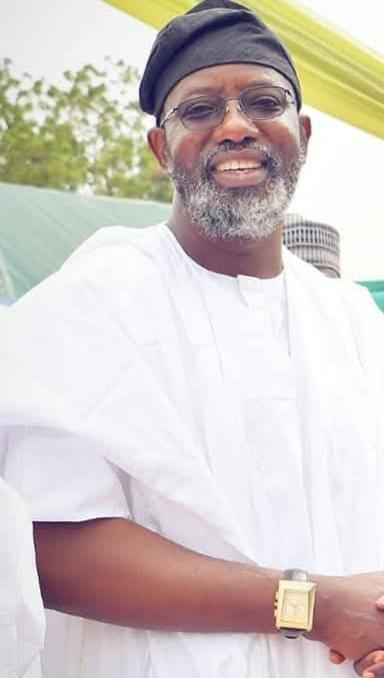

President Tinubu still has a choice. He can reorder priorities toward production, manufacturing, and value creation, or persist on a path that both Nigerians and global history have already condemned. Governments that build are supported. Governments that only collect are resisted. Nigeria must not be ruled as a tax farm. It must be governed as a nation- Hon Zakari Mohammed, who was the spokesman for 7th House of Representatives, writes from Abuja